Agility Ventures

Agility’s corporate venture arm invests in emerging technology companies that contribute to digital supply chain, climate action, small and medium-sized business empowerment, and more.

Submit PitchAgility Ventures is the corporate venture arm of Agility. We partner with companies that are championing technology that will be the foundation for faster, cleaner, fairer, stronger and more resilient supply chains, and beyond. We offer our partners more than just capital. Agility offers a global network of resources and the market access needed to grow great companies.

Featured Ventures Investments

Hyliion

Based in the United States, develops innovative, clean, flexible and scalable energy generation technology. Its signature innovation, the KARNO™ is an additive manufacturing enabled generator technology that uses heat to drive a sealed electricity producing linear generator.

Shiprocket

Shiprocket is a last-mile delivery aggregator and e-commerce order management platform based in New Dehli, India.

Loop Global

Loop Global is a leader in the development of hardware and software for electric-vehicle (EV) charging stations and networks.

TVP Solar

Based in Switzerland, designs and manufactures high-performing solar panels that use vacuum technology to efficiently deliver solar thermal energy more consistently and under more varied and extreme conditions with less maintenance.

Frete.com

Brazil’s largest freight marketplace uses technology to create a more efficient cargo transport market by connecting shippers, transportation providers and truckers.

Zid

Zid, an e-commerce enablement specialist based in Saudi Arabia, helps merchants and entrepreneurs build online stores without technical expertise, and connects them with suppliers and partners.

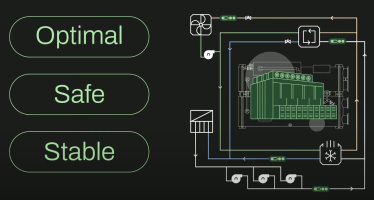

Phaidra

Phaidra, based in the United States, builds AI agents and AI-driven control systems that optimize data center performance by improving energy efficiency, increasing reliability, maximizing IT capacity, and allowing for faster decision-making and troubleshooting.